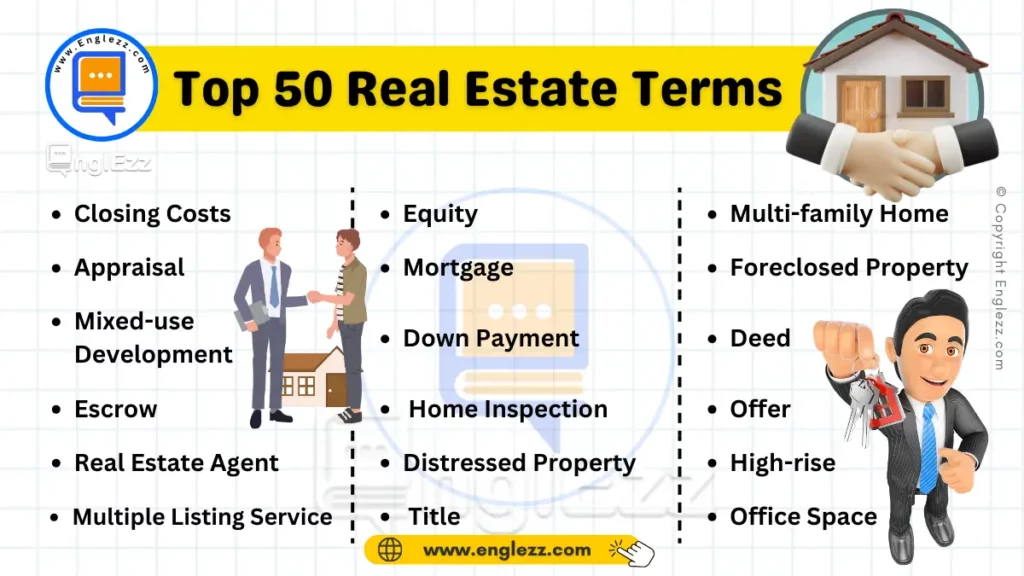

The real estate industry is a complex field that involves buying, selling, and managing properties. For students studying real estate, mastering industry-specific vocabulary is crucial for effective communication and understanding of key concepts. We’ve compiled a list of 50 essential real estate English terms that every student must know.

Each term includes a clear definition, phonetic transcription, and practical examples to illustrate how these terms are used in context. Real estate terms can range from legal jargon to financial terminology, and understanding these terms is essential for success in this field.

Table of Contents

- 50 Essential Real Estate English Terms Every Student Must Know

- #1. 📜 “Title” – /ˈtaɪtəl/

- #2. 📑 “Deed” – /diːd/

- #3. 🏠 “Mortgage” – /ˈmɔːrɡɪdʒ/

- #4. 📝 “Lease” – /liːs/

- #5. 🏢 “Condominium” – /ˌkɒndəˈmɪniəm/

- #6. 📈 “Appraisal” – /əˈpreɪzəl/

- #7. 🧾 “Escrow” – /ˈɛskroʊ/

- #8. 💰 “Equity” – /ˈɛkwɪti/

- #9. 🏗️ “Zoning” – /ˈzoʊnɪŋ/

- #10. 🏦 “Foreclosure” – /fɔːrˈkloʊʒər/

- #11. 📅 “Closing” – /ˈkloʊzɪŋ/

- #12. 🌆 “Urban Renewal” – /ˈɜːrbən rɪˈnuːəl/

- #13. 🛠️ “Renovation” – /ˌrɛnəˈveɪʃən/

- #14. 🏚️ “Fixer-Upper” – /ˌfɪksər ˈʌpər/

- #15. 📊 “Real Estate Market” – /rɪəl ɪˈsteɪt ˈmɑːrkɪt/

- #16. 🏘️ “Duplex” – /ˈdjuːplɛks/

- #17. 🏘️ “Triplex” – /ˈtraɪplɛks/

- #18. 🌳 “Landscaping” – /ˈlændskeɪpɪŋ/

- #19. 🏢 “Commercial Property” – /kəˈmɜːrʃəl ˈprɒpərti/

- #20. 🏡 “Residential Property” – /ˌrɛzɪˈdɛnʃəl ˈprɒpərti/

- #21. 🏢 “Industrial Property” – /ɪnˈdʌstriəl ˈprɒpərti/

- #22. 🏘️ “Multi-family Home” – /ˈmʌlti-ˈfæmɪli hoʊm/

- #23. 🏚️ “Foreclosed Property” – /fɔːrˈkloʊzd ˈprɒpərti/

- #24. 🏢 “Mixed-use Development” – /ˈmɪkst-juːs dɪˈvɛləpmənt/

- #25. 🏚️ “Distressed Property” – /dɪˈstrɛst ˈprɒpərti/

- #26. 🏙️ “High-rise” – /ˈhaɪˌraɪz/

- #27. 🏢 “Office Space” – /ˈɒfɪs speɪs/

- #28. 🏗️ “Construction” – /kənˈstrʌkʃən/

- #29. 📋 “Property Management” – /ˈprɒpərti ˈmænɪdʒmənt/

- #30. 🏘️ “Subdivision” – /ˈsʌbdɪˌvɪʒən/

- #31. 🏠 “Single-family Home” – /ˈsɪŋɡəl-ˈfæmɪli hoʊm/

- #32. 🏢 “Tenancy” – /ˈtɛnənsi/

- #33. 🏗️ “Infrastructure” – /ˈɪnfrəˌstrʌktʃər/

- #34. 🏢 “Real Estate Investment Trust (REIT)” – /riːt/

- #35. 🏘️ “Co-op” – /koʊˈɑp/

- #36. 🏢 “Real Estate Agent” – /ˈrɪəl ɪˈsteɪt ˈeɪdʒənt/

- #37. 🏗️ “Development” – /dɪˈvɛləpmənt/

- #38. 🏠 “Homeowner’s Association (HOA)” – /ˈhoʊmˌoʊnərz əˌsoʊʃiˈeɪʃən/

- #39. 🏢 “Retail Space” – /ˈriːteɪl speɪs/

- #40. 🏢 “Warehouse” – /ˈwɛərhaʊs/

- #41. 🏢 “Property Tax” – /ˈprɒpərti tæks/

- #42. 🏢 “Capitalization Rate” – /ˌkæpɪtəlaɪˈzeɪʃən reɪt/

- #43. 🏢 “Short Sale” – /ʃɔːrt seɪl/

- #44. 🏢 “Title Insurance” – /ˈtaɪtl ɪnˈʃʊrəns/

- #45. 🏢 “Escrow” – /ˈɛskroʊ/

- #46. 🏢 “Home Equity Line of Credit (HELOC)” – /hoʊm ˈɛkwɪti laɪn əv ˈkrɛdɪt/

- #47. 🏢 “Refinancing” – /ˌriːˈfaɪnænsɪŋ/

- #48. 🏢 “FHA Loan” – /ɛf-eɪtʃ-eɪ loʊn/

- #49. 🏢 “Jumbo Loan” – /ˈdʒʌmboʊ loʊn/

- #50. 🏢 “Real Estate Appraiser” – /ˈrɪəl ɪˈsteɪt əˈpreɪzər/

- Real Estate English Terms Table

- Conclusion

50 Essential Real Estate English Terms Every Student Must Know

Whether you’re preparing for a career in real estate or just looking to enhance your knowledge, this guide is designed to help you navigate the complex language of the industry.

By familiarizing yourself with these terms, you’ll be better equipped to understand real estate transactions, engage in professional discussions, and make informed decisions. Let’s dive into the world of real estate vocabulary and boost your confidence in mastering this specialized language.

#1. 📜 “Title” – /ˈtaɪtəl/

The “title” refers to the legal right to own a property. It’s a document that proves ownership and details the rights of the property owner.

- Example 1: Before buying a house, it’s essential to ensure that the seller has a clear title to avoid legal disputes.

- Example 2: The title search revealed no outstanding liens or encumbrances on the property.

#2. 📑 “Deed” – /diːd/

A “deed” is a legal document that transfers ownership of a property from one party to another.

- Example 1: After closing, the buyer received the deed to the new property.

- Example 2: The deed must be signed and notarized to be legally binding.

#3. 🏠 “Mortgage” – /ˈmɔːrɡɪdʒ/

A “mortgage” is a loan used to purchase real estate, where the property serves as collateral for the loan.

- Example 1: The couple took out a 30-year mortgage to buy their first home.

- Example 2: Failing to make mortgage payments can lead to foreclosure.

#4. 📝 “Lease” – /liːs/

A “lease” is a contract outlining the terms under which one party agrees to rent property from another party.

- Example 1: The tenant signed a one-year lease for the apartment.

- Example 2: The lease included a clause allowing pets.

#5. 🏢 “Condominium” – /ˌkɒndəˈmɪniəm/

A “condominium” is a type of real estate where individual units are owned separately but common areas are shared among all owners.

- Example 1: They bought a condominium in the city to avoid the maintenance of a standalone house.

- Example 2: The condominium association manages the building’s exterior and common areas.

#6. 📈 “Appraisal” – /əˈpreɪzəl/

An “appraisal” is a professional assessment of a property’s market value.

- Example 1: The bank required an appraisal before approving the mortgage.

- Example 2: The appraisal determined that the house was worth more than the asking price.

#7. 🧾 “Escrow” – /ˈɛskroʊ/

“Escrow” is a financial arrangement where a third party holds funds or property until certain conditions are met.

- Example 1: The buyer’s deposit was placed in escrow until the closing date.

- Example 2: The escrow account ensures all conditions of the sale are met before funds are released.

#8. 💰 “Equity” – /ˈɛkwɪti/

“Equity” refers to the difference between the market value of a property and the amount owed on the mortgage.

- Example 1: As they paid off their mortgage, their equity in the home increased.

- Example 2: Home equity can be used as collateral for a loan.

#9. 🏗️ “Zoning” – /ˈzoʊnɪŋ/

“Zoning” refers to the laws that define how property in specific geographic zones can be used.

- Example 1: The zoning laws prohibit building commercial properties in this residential area.

- Example 2: The developer applied for a zoning change to build a new apartment complex.

#10. 🏦 “Foreclosure” – /fɔːrˈkloʊʒər/

“Foreclosure” is the legal process by which a lender takes possession of a property when the borrower fails to make mortgage payments.

- Example 1: They faced foreclosure after missing several mortgage payments.

- Example 2: The foreclosure process can take several months, giving the borrower time to rectify the situation.

#11. 📅 “Closing” – /ˈkloʊzɪŋ/

“Closing” is the final step in a real estate transaction, where ownership is officially transferred from the seller to the buyer.

- Example 1: The closing was scheduled for next Friday, after all documents were finalized.

- Example 2: At closing, the buyer signed the mortgage documents and received the keys.

#12. 🌆 “Urban Renewal” – /ˈɜːrbən rɪˈnuːəl/

“Urban renewal” refers to the process of revitalizing deteriorated urban areas by renovating or replacing old buildings and infrastructure.

- Example 1: The city’s urban renewal project transformed the old industrial district into a vibrant community.

- Example 2: Urban renewal efforts often include improving public transportation and amenities.

#13. 🛠️ “Renovation” – /ˌrɛnəˈveɪʃən/

“Renovation” is the process of improving a building by making repairs or adding new features.

- Example 1: They decided to undertake a kitchen renovation to increase their home’s value.

- Example 2: The old theater underwent a major renovation to restore its historic charm.

#14. 🏚️ “Fixer-Upper” – /ˌfɪksər ˈʌpər/

A “fixer-upper” is a property that requires repairs or renovations, typically sold at a lower price.

- Example 1: They bought a fixer-upper to renovate and sell for a profit.

- Example 2: Purchasing a fixer-upper can be a great way to invest in real estate.

#15. 📊 “Real Estate Market” – /rɪəl ɪˈsteɪt ˈmɑːrkɪt/

The “real estate market” refers to the supply and demand for properties in a particular area.

- Example 1: The real estate market in the city is highly competitive, with properties selling quickly.

- Example 2: Understanding the real estate market is crucial for making informed investment decisions.

#16. 🏘️ “Duplex” – /ˈdjuːplɛks/

A “duplex” is a type of residential building that has two separate units, often sharing a common wall.

- Example 1: They rented one side of the duplex and lived in the other.

- Example 2: A duplex can be a great option for those looking to generate rental income.

#17. 🏘️ “Triplex” – /ˈtraɪplɛks/

A “triplex” is a residential building divided into three separate units, usually with a shared common wall.

- Example 1: The family invested in a triplex to diversify their rental income.

- Example 2: Each unit in the triplex had its own entrance and utilities.

#18. 🌳 “Landscaping” – /ˈlændskeɪpɪŋ/

“Landscaping” involves modifying the visible features of an area of land, including planting trees and shrubs, to make it more attractive.

- Example 1: They hired a professional for the landscaping of their front yard.

- Example 2: Good landscaping can significantly increase a property’s curb appeal.

#19. 🏢 “Commercial Property” – /kəˈmɜːrʃəl ˈprɒpərti/

“Commercial property” refers to buildings or land intended for profit-making activities, such as offices, retail spaces, or warehouses.

- Example 1: They leased a commercial property downtown to open their new store.

- Example 2: Commercial property investment can yield high returns with the right tenants.

#20. 🏡 “Residential Property” – /ˌrɛzɪˈdɛnʃəl ˈprɒpərti/

“Residential property” refers to real estate primarily used for housing, such as houses, apartments, and townhomes.

- Example 1: They bought a residential property in a quiet neighborhood.

- Example 2: The value of residential properties has been steadily increasing over the past few years.

#21. 🏢 “Industrial Property” – /ɪnˈdʌstriəl ˈprɒpərti/

“Industrial property” refers to buildings or land used for manufacturing, production, storage, and distribution.

- Example 1: The company purchased an industrial property to expand its manufacturing operations.

- Example 2: Industrial properties are often located in designated industrial zones away from residential areas.

#22. 🏘️ “Multi-family Home” – /ˈmʌlti-ˈfæmɪli hoʊm/

A “multi-family home” is a single building designed to accommodate multiple separate households.

- Example 1: They invested in a multi-family home to generate additional rental income.

- Example 2: Multi-family homes are popular in urban areas where space is limited.

#23. 🏚️ “Foreclosed Property” – /fɔːrˈkloʊzd ˈprɒpərti/

A “foreclosed property” is a home that has been repossessed by a lender due to the owner’s failure to make mortgage payments.

- Example 1: They bought a foreclosed property at an auction for a fraction of its market value.

- Example 2: Foreclosed properties often require significant repairs and renovations.

#24. 🏢 “Mixed-use Development” – /ˈmɪkst-juːs dɪˈvɛləpmənt/

“Mixed-use development” refers to a type of urban development that combines residential, commercial, and recreational spaces in one area.

- Example 1: The new mixed-use development downtown includes shops, offices, and apartments.

- Example 2: Mixed-use developments are popular in cities looking to maximize land use.

#25. 🏚️ “Distressed Property” – /dɪˈstrɛst ˈprɒpərti/

A “distressed property” is a home that is under foreclosure or being sold at a reduced price due to financial hardship.

- Example 1: Distressed properties can be a good investment opportunity for experienced buyers.

- Example 2: They purchased a distressed property and renovated it to sell at a profit.

#26. 🏙️ “High-rise” – /ˈhaɪˌraɪz/

A “high-rise” is a building that is significantly taller than the surrounding buildings, typically used for residential or commercial purposes.

- Example 1: They moved into a high-rise apartment with a great view of the city skyline.

- Example 2: High-rise buildings are common in densely populated urban areas.

#27. 🏢 “Office Space” – /ˈɒfɪs speɪs/

“Office space” refers to a building or part of a building used for professional or business activities.

- Example 1: The company leased office space in a downtown high-rise.

- Example 2: The demand for office space has decreased with the rise of remote work.

#28. 🏗️ “Construction” – /kənˈstrʌkʃən/

“Construction” is the process of building or assembling infrastructure, such as homes, offices, or bridges.

- Example 1: The construction of the new shopping center is expected to be completed next year.

- Example 2: Construction delays can significantly impact project timelines and budgets.

#29. 📋 “Property Management” – /ˈprɒpərti ˈmænɪdʒmənt/

“Property management” involves overseeing and managing real estate properties, including renting, maintenance, and financial aspects.

- Example 1: They hired a property management company to handle the leasing and maintenance of their rental properties.

- Example 2: Good property management can increase the profitability of rental investments.

#30. 🏘️ “Subdivision” – /ˈsʌbdɪˌvɪʒən/

A “subdivision” is a tract of land divided into smaller plots for the purpose of building homes or commercial properties.

- Example 1: The new subdivision features modern homes with spacious yards.

- Example 2: Subdivisions often have community amenities like parks and swimming pools.

#31. 🏠 “Single-family Home” – /ˈsɪŋɡəl-ˈfæmɪli hoʊm/

A “single-family home” is a standalone residential structure designed to house one family.

- Example 1: They purchased a single-family home with a large backyard.

- Example 2: Single-family homes are popular in suburban areas.

#32. 🏢 “Tenancy” – /ˈtɛnənsi/

“Tenancy” refers to the occupancy of property by a tenant under a lease or rental agreement.

- Example 1: The tenancy agreement was signed for a two-year period.

- Example 2: The landlord is responsible for property maintenance during the tenancy.

#33. 🏗️ “Infrastructure” – /ˈɪnfrəˌstrʌktʃər/

“Infrastructure” refers to the physical structures and facilities needed for the operation of a society or enterprise, such as roads, bridges, and utilities.

- Example 1: The city’s infrastructure improvements include new roads and updated sewage systems.

- Example 2: Good infrastructure is essential for supporting growing populations.

#34. 🏢 “Real Estate Investment Trust (REIT)” – /riːt/

A “Real Estate Investment Trust (REIT)” is a company that owns, operates, or finances income-producing real estate.

- Example 1: Investing in a REIT allows individuals to invest in large-scale properties without owning them directly.

- Example 2: REITs offer investors the opportunity to diversify their portfolios with real estate assets.

#35. 🏘️ “Co-op” – /koʊˈɑp/

A “co-op” is a type of housing where residents own shares in a corporation that owns the building and, in turn, have the right to occupy a specific unit.

- Example 1: They purchased shares in a co-op, allowing them to live in the building and have a say in its management.

- Example 2: Co-ops often have stricter rules for buyers compared to condominiums.

#36. 🏢 “Real Estate Agent” – /ˈrɪəl ɪˈsteɪt ˈeɪdʒənt/

A “real estate agent” is a licensed professional who represents buyers or sellers in real estate transactions.

- Example 1: They hired a real estate agent to help them find their dream home.

- Example 2: A good real estate agent can provide valuable market insights and negotiate favorable deals.

#37. 🏗️ “Development” – /dɪˈvɛləpmənt/

“Development” refers to the process of constructing new buildings or altering existing ones for residential, commercial, or industrial purposes.

- Example 1: The development of the new residential complex is underway.

- Example 2: Sustainable development practices are becoming increasingly important in real estate.

#38. 🏠 “Homeowner’s Association (HOA)” – /ˈhoʊmˌoʊnərz əˌsoʊʃiˈeɪʃən/

A “Homeowner’s Association (HOA)” is an organization that makes and enforces rules for properties within a community.

- Example 1: The HOA manages common areas and enforces community rules and regulations.

- Example 2: Residents pay monthly fees to the HOA for the upkeep of shared amenities.

#39. 🏢 “Retail Space” – /ˈriːteɪl speɪs/

“Retail space” refers to property used for selling goods and services to consumers, such as stores or shopping malls.

- Example 1: The company leased retail space in the new shopping center for their boutique.

- Example 2: High foot traffic locations are ideal for retail space investments.

#40. 🏢 “Warehouse” – /ˈwɛərhaʊs/

A “warehouse” is a large building used for storing goods and materials.

- Example 1: The business rented a warehouse to store inventory.

- Example 2: Warehouses are often located near major transportation hubs for easy distribution.

#41. 🏢 “Property Tax” – /ˈprɒpərti tæks/

“Property tax” is a tax levied by the government on real estate based on its assessed value.

- Example 1: Homeowners must pay property taxes annually based on the value of their property.

- Example 2: Property taxes are used to fund public services like schools and emergency services.

#42. 🏢 “Capitalization Rate” – /ˌkæpɪtəlaɪˈzeɪʃən reɪt/

The “capitalization rate” is a metric used to evaluate the potential return on a real estate investment, calculated as the property’s net operating income divided by its current market value.

- Example 1: A higher capitalization rate indicates a potentially more profitable investment.

- Example 2: Investors use the capitalization rate to compare different real estate opportunities.

#43. 🏢 “Short Sale” – /ʃɔːrt seɪl/

A “short sale” occurs when a homeowner sells their property for less than the outstanding mortgage balance, often to avoid foreclosure.

- Example 1: The homeowner opted for a short sale to avoid foreclosure and minimize financial loss.

- Example 2: Short sales can be a good opportunity for buyers to purchase homes below market value.

#44. 🏢 “Title Insurance” – /ˈtaɪtl ɪnˈʃʊrəns/

“Title insurance” protects property buyers and lenders against losses from disputes over property ownership.

- Example 1: They purchased title insurance to ensure their ownership rights were protected.

- Example 2: Title insurance is a one-time purchase that covers potential legal fees in ownership disputes.

#45. 🏢 “Escrow” – /ˈɛskroʊ/

“Escrow” is a financial arrangement where a third party holds funds or property until certain conditions are met in a real estate transaction.

- Example 1: The funds were held in escrow until all the terms of the contract were fulfilled.

- Example 2: Using escrow ensures that both the buyer and seller are protected during the transaction.

#46. 🏢 “Home Equity Line of Credit (HELOC)” – /hoʊm ˈɛkwɪti laɪn əv ˈkrɛdɪt/

A “Home Equity Line of Credit (HELOC)” is a loan that allows homeowners to borrow against the equity in their home, often used for home improvements or debt consolidation.

- Example 1: They took out a HELOC to finance their kitchen remodel.

- Example 2: A HELOC provides flexibility for homeowners to access funds as needed.

#47. 🏢 “Refinancing” – /ˌriːˈfaɪnænsɪŋ/

“Refinancing” is the process of replacing an existing mortgage with a new one, typically with better terms or a lower interest rate.

- Example 1: They refinanced their mortgage to take advantage of lower interest rates.

- Example 2: Refinancing can help homeowners save money over the life of the loan.

#48. 🏢 “FHA Loan” – /ɛf-eɪtʃ-eɪ loʊn/

An “FHA Loan” is a mortgage backed by the Federal Housing Administration, designed to help low- to moderate-income borrowers buy homes with lower down payments and more flexible credit requirements.

- Example 1: They qualified for an FHA loan due to their low down payment.

- Example 2: FHA loans are popular among first-time homebuyers.

#49. 🏢 “Jumbo Loan” – /ˈdʒʌmboʊ loʊn/

A “jumbo loan” is a mortgage that exceeds the conforming loan limits set by the Federal Housing Finance Agency (FHFA), often used for purchasing luxury properties.

- Example 1: They secured a jumbo loan to buy their dream home in the upscale neighborhood.

- Example 2: Jumbo loans typically have stricter credit requirements due to their larger size.

#50. 🏢 “Real Estate Appraiser” – /ˈrɪəl ɪˈsteɪt əˈpreɪzər/

A “real estate appraiser” is a professional who assesses the market value of properties based on various factors such as location, condition, and comparable sales.

- Example 1: The real estate appraiser provided a detailed report on the property’s value.

- Example 2: Lenders require a real estate appraisal before approving a mortgage to ensure the loan amount is appropriate.

Real Estate English Terms Table

| 1. Closing Costs | 11. Equity | 21. Multi-family Home |

| 2. Appraisal | 12. Mortgage | 22. Foreclosed Property |

| 3. Deed | 13. Down Payment | 23. Mixed-use Development |

| 4. Escrow | 14. Home Inspection | 24. Distressed Property |

| 5. Real Estate Agent | 15. Offer | 25. High-rise |

| 6. MLS (Multiple Listing Service) | 16. Title | 26. Office Space |

| 7. Lease | 17. Zoning | 27. Construction |

| 8. HOA (Homeowners Association) | 18. Capitalization Rate | 28. Property Management |

| 9. REIT (Real Estate Investment Trust) | 19. Tenancy | 29. Subdivision |

| 10. Condominium | 20. Infrastructure | 30. Single-family Home |

| 31. Co-op | 41. Property Tax | 51. Real Estate Appraiser |

| 32. Retail Space | 42. Capitalization Rate | 52. Short Sale |

| 33. Warehouse | 43. Title Insurance | 53. Refinancing |

| 34. Home Equity Line of Credit | 44. Escrow | 54. FHA Loan |

| 35. Development | 45. Real Estate Appraiser | 55. Jumbo Loan |

| 36. Title | 46. Foreclosed Property | 56. Real Estate Agent |

| 37. Lease | 47. Homeowners Association (HOA) | 57. Tenancy |

| 38. Appraisal | 48. Real Estate Investment Trust (REIT) | 58. Real Estate Market |

| 39. Down Payment | 49. Condominium | 59. Short Sale |

| 40. Mortgage | 50. Property Management | 60. Refinancing |

Conclusion

Understanding real estate terminology is crucial for anyone interested in the field, whether you’re a student, a first-time homebuyer, or a seasoned investor. From the basics of property types and ownership structures to the complexities of financing and investment strategies, these terms provide a foundation for making informed decisions in the real estate market.

Having a solid grasp of these 50 essential real estate terms empowers individuals to navigate the complexities of buying, selling, and investing in properties. It enables better communication with real estate professionals, understanding of market trends, and the ability to assess investment opportunities effectively.

Whether you are pursuing a career in real estate or simply seeking to expand your knowledge, mastering this vocabulary is a vital step toward achieving your goals. So, continue exploring, learning, and applying these concepts to make the most of your real estate journey.

Unlock your potential in the real estate world! 🏠✨ Discover these 50 essential terms to boost your understanding and navigate the market with confidence. Ready to level up your vocabulary? 📚 Follow and like @EnglEzz for more insights! Check it out here:

.

http://www.englezz.com/?p=19568

.

#englezz #vocabulary #linguistics #realestate #propertyinvestment #learnenglish #realestatetips #englishlanguage #realestateinvesting