Accounting is often referred to as the language of business, and mastering its terminology is essential for anyone involved in finance, whether you’re an aspiring accountant, a business owner, or just someone interested in understanding financial statements. This comprehensive guide covers 50 of the most common accounting English terms, providing clear definitions, phonetic transcriptions, and examples to help you grasp their meanings and uses.

Table of Contents

- 50 Most Common accounting English Terms Explained with Examples

- #1. 📊 Assets /ˈæsɛts/

- #2. 📉 Liabilities /ˌlaɪəˈbɪlɪtiz/

- #3. 💼 Equity /ˈɛkwɪti/

- #4. 💰 Revenue /ˈrɛvɪnjuː/

- #5. 🏦 Expenses /ɪkˈspɛnsɪz/

- #6. 📅 Accounts Receivable /əˈkaʊnts rɪˈsiːvəbl/

- #7. 🧾 Accounts Payable /əˈkaʊnts ˈpeɪəbl/

- #8. 📈 Balance Sheet /ˈbæləns ʃiːt/

- #9. 💸 Cash Flow /kæʃ fləʊ/

- #10. 🧮 Income Statement /ˈɪnkʌm ˈsteɪtmənt/

- #11. 📉 Depreciation /dɪˌpriːʃɪˈeɪʃən/

- #12. 💳 Accrual /əˈkruːəl/

- #13. 🧑💻 Audit /ˈɔːdɪt/

- #14. 📄 Ledger /ˈlɛdʒər/

- #15. 📜 Trial Balance /ˈtraɪəl ˈbæləns/

- #16. 💼 Capital /ˈkæpɪtl/

- #17. 📉 Dividend /ˈdɪvɪdɛnd/

- #18. 🧮 Double-Entry Accounting /ˈdʌbəl ˈɛntri əˈkaʊntɪŋ/

- #19. 🏢 Fixed Assets /fɪkst ˈæsɛts/

- #20. 📅 Fiscal Year /ˈfɪskl jɪər/

- #21. 📈 General Ledger /ˈdʒɛnərəl ˈlɛdʒər/

- #22. 💳 Gross Profit /ɡrɔs ˈprɒfɪt/

- #23. 📉 Journal /ˈdʒɜːrnəl/

- #24. 💼 Liability /ˌlaɪəˈbɪlɪti/

- #25. 💰 Net Income /nɛt ˈɪnkʌm/

- #26. 🧾 Operating Expenses /ˈɒpəreɪtɪŋ ɪkˈspɛnsɪz/

- #27. 💸 Overhead /ˈoʊvərˌhɛd/

- #28. 💳 Payroll /ˈpeɪroʊl/

- #29. 🏦 Retained Earnings /rɪˈteɪnd ˈɜrnɪŋz/

- #30. 🧾 Trial Balance /ˈtraɪəl ˈbælənz/

- #31. 📉 Working Capital /ˈwɜrkɪŋ ˈkæpɪtl/

- #32. 💳 Audit Trail /ˈɔːdɪt treɪl/

- #33. 🏦 Capital Expenditure /ˈkæpɪtl ɪkˈspɛndɪtʃər/

- #34. 📉 Cost of Goods Sold (COGS) /kɒst əv ɡʊdz soʊld/

- #35. 🏦 Credit /ˈkrɛdɪt/

- #36. 📈 Debit /ˈdɛbɪt/

- #37. 💼 General Journal /ˈdʒɛnərəl ˈdʒɜrnəl/

- #38. 🏢 Net Worth /nɛt wɜrθ/

- #39. 💳 Prepaid Expenses /priːˈpeɪd ɪkˈspɛnsɪz/

- #40. 🧾 Profit and Loss Statement /ˈprɒfɪt ənd lɒs ˈsteɪtmənt/

- #41. 📊 Reconciliation /ˌrɛkənsɪliˈeɪʃən/

- #42. 🏦 Share Capital /ʃɛr ˈkæpɪtl/

- #43. 📈 Taxable Income /ˈtæksəbl ˈɪnkʌm/

- #44. 💰 Trial Balance /ˈtraɪəl ˈbæləns/

- #45. 🏦 Variable Costs /ˈvɛəriəbl kɒsts/

- #46. 💼 Wages /weɪdʒɪz/

- #47. 🧾 Write-Off /raɪt ɒf/

- #48. 🏦 Yield /jiːld/

- #49. 📉 Zero-Based Budgeting /ˈzɪərəʊ beɪst ˈbʌdʒɪtɪŋ/

- #50. 📅 Year-End /jɪər ɛnd/

- Accounting Terms Table

- Conclusion

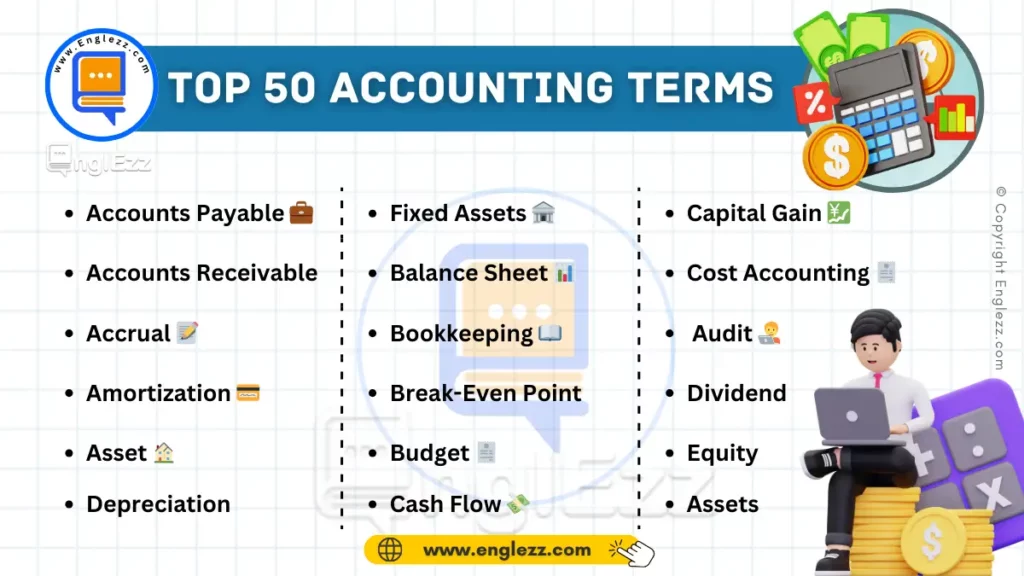

50 Most Common accounting English Terms Explained with Examples

Understanding these terms will not only enhance your financial literacy but also boost your confidence in navigating the financial world. Whether you’re preparing for an exam, managing a business, or just looking to improve your knowledge, this guide is designed to make accounting concepts accessible and understandable.

Let’s dive into the top accounting terms that every professional should know!

#1. 📊 Assets /ˈæsɛts/

Definition: Resources owned by a business that have economic value.

Examples:

- “The company’s assets include cash, inventory, and property.”

- “Assets are listed on the balance sheet.”

#2. 📉 Liabilities /ˌlaɪəˈbɪlɪtiz/

Definition: Obligations or debts that a business owes to others.

Examples:

- “Liabilities must be settled by the company in the future.”

- “The business has liabilities such as loans and accounts payable.”

#3. 💼 Equity /ˈɛkwɪti/

Definition: The residual interest in the assets of the entity after deducting liabilities.

Examples:

- “Equity represents the ownership value in a company.”

- “Shareholders’ equity is found on the balance sheet.”

#4. 💰 Revenue /ˈrɛvɪnjuː/

Definition: The total amount of income generated by the sale of goods or services.

Examples:

- “The company’s revenue has increased by 10% this year.”

- “Revenue is recorded on the income statement.”

#5. 🏦 Expenses /ɪkˈspɛnsɪz/

Definition: The costs incurred by a business in the process of earning revenue.

Examples:

- Rent and utilities are common business expenses.

- “Expenses reduce the company’s net income.”

#6. 📅 Accounts Receivable /əˈkaʊnts rɪˈsiːvəbl/

Definition: Money owed to a company by its customers for goods or services delivered.

Examples:

- “Accounts receivable is considered an asset on the balance sheet.”

- “The company has $50,000 in accounts receivable.”

#7. 🧾 Accounts Payable /əˈkaʊnts ˈpeɪəbl/

Definition: Money that a company owes to its suppliers or creditors.

Examples:

- Accounts payable needs to be settled within 30 days.”

- “The company’s accounts payable include invoices from vendors.”

#8. 📈 Balance Sheet /ˈbæləns ʃiːt/

Definition: A financial statement that summarizes a company’s assets, liabilities, and equity at a specific point in time.

Examples:

- “The balance sheet gives a snapshot of the company’s financial position.”

- “Assets and liabilities are balanced on the balance sheet.”

#9. 💸 Cash Flow /kæʃ fləʊ/

Definition: The movement of money into and out of a business.

Examples:

- “Cash flow management is critical for business success.”

- “Positive cash flow indicates more money is coming in than going out.”

#10. 🧮 Income Statement /ˈɪnkʌm ˈsteɪtmənt/

Definition: A financial statement that shows a company’s revenues and expenses over a period of time.

Examples:

- “The income statement helps determine net profit.”

- “Revenue and expenses are detailed on the income statement.”

#11. 📉 Depreciation /dɪˌpriːʃɪˈeɪʃən/

Definition: The reduction in the value of an asset over time due to wear and tear.

Examples:

- “Depreciation is recorded as an expense on the income statement.”

- “Assets like machinery and vehicles depreciate over time.”

#12. 💳 Accrual /əˈkruːəl/

Definition: Recognition of revenue or expenses when they are earned or incurred, regardless of when cash is received or paid.

Examples:

- “Accrual accounting provides a more accurate financial picture.”

- “Interest accrual is recorded at the end of each month.”

#13. 🧑💻 Audit /ˈɔːdɪt/

Definition: An official inspection of an organization’s accounts, typically by an independent body.

Examples:

- “The company undergoes an annual audit to ensure accuracy.”

- “Auditors review financial statements for compliance.”

#14. 📄 Ledger /ˈlɛdʒər/

Definition: A book or other collection of financial accounts.

Examples:

- “All transactions are recorded in the company’s ledger.”

- “The ledger is essential for tracking financial data.”

#15. 📜 Trial Balance /ˈtraɪəl ˈbæləns/

Definition: A bookkeeping worksheet in which the balance of all ledgers are compiled into debit and credit columns.

Examples:

- “The trial balance ensures that debits equal credits.”

- “Any discrepancies in the trial balance need investigation.”

#16. 💼 Capital /ˈkæpɪtl/

Definition: Wealth in the form of money or assets, used to start or maintain a business.

Examples:

- “The company raised capital to fund its expansion.”

- “Capital investment is crucial for growth.”

#17. 📉 Dividend /ˈdɪvɪdɛnd/

Definition: A sum of money paid regularly by a company to its shareholders out of its profits.

Examples:

- “The company declared a dividend of $2 per share.”

- “Dividends are distributed quarterly.”

#18. 🧮 Double-Entry Accounting /ˈdʌbəl ˈɛntri əˈkaʊntɪŋ/

Definition: A system of bookkeeping where every entry to an account requires a corresponding and opposite entry to a different account.

Examples:

- “Double-entry accounting ensures the accounting equation stays balanced.”

- “Every transaction affects two accounts in double-entry accounting.”

#19. 🏢 Fixed Assets /fɪkst ˈæsɛts/

Definition: Long-term tangible property that a firm owns and uses in its operations to generate income.

Examples:

- “Fixed assets include buildings, machinery, and equipment.”

- “Depreciation is applied to fixed assets over time.”

#20. 📅 Fiscal Year /ˈfɪskl jɪər/

Definition: A year as reckoned for taxing or accounting purposes, not necessarily coinciding with the calendar year.

Examples:

#21. 📈 General Ledger /ˈdʒɛnərəl ˈlɛdʒər/

Definition: A complete record of all financial transactions over the life of a company.

Examples:

- “The general ledger contains all the accounts for the company.”

- “Every transaction is recorded in the general ledger.”

#22. 💳 Gross Profit /ɡrɔs ˈprɒfɪt/

Definition: The profit a company makes after deducting the costs associated with making and selling its products.

Examples:

- “Gross profit is calculated before operating expenses.”

- “High gross profit indicates efficient production.”

#23. 📉 Journal /ˈdʒɜːrnəl/

Definition: A record where all transactions are initially noted.

Examples:

- Entries are made in the journal before posting to the ledger.

- “The journal is essential for accurate bookkeeping.”

#24. 💼 Liability /ˌlaɪəˈbɪlɪti/

Definition: A company’s legal financial debts or obligations that arise during the course of business operations.

Examples:

- “Liabilities are listed on the balance sheet.”

- “The business must settle its liabilities in due time.”

#25. 💰 Net Income /nɛt ˈɪnkʌm/

Definition: The total profit of a company after all expenses and taxes have been deducted from revenue.

Examples:

- “Net income is the bottom line of the income statement.”

- “Positive net income indicates profitability.”

#26. 🧾 Operating Expenses /ˈɒpəreɪtɪŋ ɪkˈspɛnsɪz/

Definition: Expenses incurred in the normal course of business operations.

Examples:

- Rent and salaries are examples of operating expenses.

- “Operating expenses are subtracted from gross profit.”

#27. 💸 Overhead /ˈoʊvərˌhɛd/

Definition: The ongoing administrative expenses of a business that are not directly attributable to a specific business activity.

Examples:

- “Overhead costs include utilities and insurance.”

- “Controlling overhead is key to maintaining profitability.”

#28. 💳 Payroll /ˈpeɪroʊl/

Definition: The total amount of money that a company pays to its employees.

Examples:

- “Payroll includes wages, salaries, and deductions.”

- “The payroll is processed bi-weekly.”

#29. 🏦 Retained Earnings /rɪˈteɪnd ˈɜrnɪŋz/

Definition: The portion of net income that is retained by the company rather than distributed to shareholders as dividends.

Examples:

- “Retained earnings are used to reinvest in the company.”

- “The retained earnings balance grows with each profitable year.”

#30. 🧾 Trial Balance /ˈtraɪəl ˈbælənz/

Definition: A statement of all debits and credits in a double-entry account book, with any disagreement indicating an error.

Examples:

- “The trial balance ensures the accuracy of bookkeeping.”

- “Any imbalance in the trial balance must be corrected.”

#31. 📉 Working Capital /ˈwɜrkɪŋ ˈkæpɪtl/

Definition: The difference between a company’s current assets and current liabilities.

Examples:

- “Positive working capital indicates a company can meet its short-term obligations.

- “Working capital is essential for day-to-day operations.”

#32. 💳 Audit Trail /ˈɔːdɪt treɪl/

Definition: A step-by-step record by which accounting data can be traced to its source.

Examples:

- “An audit trail ensures transparency in financial records.”

- “Audit trails are crucial for accurate auditing.”

#33. 🏦 Capital Expenditure /ˈkæpɪtl ɪkˈspɛndɪtʃər/

Definition: Funds used by a company to acquire or upgrade physical assets such as property or equipment.

Examples:

- “Capital expenditures are recorded as assets on the balance sheet.”

- “The company’s capital expenditure increased with the purchase of new machinery.”

#34. 📉 Cost of Goods Sold (COGS) /kɒst əv ɡʊdz soʊld/

Definition: The direct costs attributable to the production of the goods sold by a company.

Examples:

- “COGS is deducted from revenue to calculate gross profit.”

- Accurate COGS calculation is essential for pricing strategy.”

#35. 🏦 Credit /ˈkrɛdɪt/

Definition: An entry recording a sum received, listed on the right-hand side or column of an account.

Examples:

- “Credits increase liabilities and equity accounts.”

- “The credit was posted to the accounts payable.”

#36. 📈 Debit /ˈdɛbɪt/

Definition: An entry recording an amount owed, listed on the left-hand side or column of an account.

Examples:

- “Debits increase assets and expenses accounts.”

- “The debit was posted to the cash account.”

#37. 💼 General Journal /ˈdʒɛnərəl ˈdʒɜrnəl/

Definition: A journal where all the accounting transactions are recorded in chronological order.

Examples:

- “The general journal is used for entries that don’t fit in other journals.”

- “Entries in the general journal are later posted to the general ledger.”

#38. 🏢 Net Worth /nɛt wɜrθ/

Definition: The total assets minus total liabilities of an individual or company.

Examples:

- Net worth reflects the financial health of a business.

- “A positive net worth indicates that assets exceed liabilities.”

#39. 💳 Prepaid Expenses /priːˈpeɪd ɪkˈspɛnsɪz/

Definition: Expenses that have been paid in advance and recorded as assets until they are used.

Examples:

- “Prepaid expenses include insurance and rent.”

- “The prepaid expense is expensed over the period it covers.”

#40. 🧾 Profit and Loss Statement /ˈprɒfɪt ənd lɒs ˈsteɪtmənt/

Definition: A financial report that summarizes the revenues, costs, and expenses incurred during a specific period.

Examples:

- “The profit and loss statement helps assess business performance.”

- “Net income is derived from the profit and loss statement.”

#41. 📊 Reconciliation /ˌrɛkənsɪliˈeɪʃən/

Definition: The process of ensuring that two sets of records are in agreement.

Examples:

- “Bank reconciliation is performed monthly.”

- “Reconciliation ensures accuracy in financial records.”

Definition: The funds raised by a company in exchange for shares of ownership.

Examples:

- “Share capital is listed under equity on the balance sheet.”

- “The company issued new shares to increase its share capital.”

#43. 📈 Taxable Income /ˈtæksəbl ˈɪnkʌm/

Definition: The amount of income used to calculate how much tax an individual or a company owes.

Examples:

- “Deductions reduce taxable income.”

- “Taxable income is reported on tax returns.”

#44. 💰 Trial Balance /ˈtraɪəl ˈbæləns/

Definition: A statement that lists the total debits and credits of all accounts in the general ledger.

Examples:

- “The trial balance ensures that total debits equal total credits.”

- “Discrepancies in the trial balance indicate errors.”

#45. 🏦 Variable Costs /ˈvɛəriəbl kɒsts/

Definition: Costs that change in proportion to the level of production or sales.

Examples:

- Raw materials are a type of variable cost.

- “Variable costs fluctuate with production levels.”

#46. 💼 Wages /weɪdʒɪz/

Definition: The fixed regular payment earned for work or services, typically paid on a daily or weekly basis.

Examples:

- “Wages are calculated based on hours worked.”

- “The company pays its employees wages every Friday.”

#47. 🧾 Write-Off /raɪt ɒf/

Definition: The reduction of the recognized value of an asset.

Examples:

- “Bad debt was written off as uncollectible.”

- “The company wrote off the obsolete inventory.”

#48. 🏦 Yield /jiːld/

Definition: The income return on an investment, usually expressed as a percentage.

Examples:

- “The bond yield is currently at 5%.”

- “High-yield investments offer higher returns.”

#49. 📉 Zero-Based Budgeting /ˈzɪərəʊ beɪst ˈbʌdʒɪtɪŋ/

Definition: A budgeting method where all expenses must be justified for each new period.

Examples:

- “Zero-based budgeting starts from a ‘zero base.'”

- “Every cost must be justified in zero-based budgeting.”

#50. 📅 Year-End /jɪər ɛnd/

Definition: The end of the fiscal or calendar year.

Examples:

- “Year-end reports are prepared to summarize financial performance.”

- “The company’s year-end is December 31.”

Accounting Terms Table

| 1. Accounts Payable 💼 | 11. Asset 🏦 | 21. Capital Gain 💹 |

| 2. Accounts Receivable 📑 | 12. Balance Sheet 📊 | 22. Cost Accounting 🧾 |

| 3. Accrual 📝 | 13. Bookkeeping 📖 | 23. Depreciation 📉 |

| 4. Amortization 💳 | 14. Break-Even Point 🧮 | 24. Dividend 💰 |

| 5. Asset 🏠 | 15. Budget 🧾 | 25. Equity 📊 |

| 6. Audit 🧑💻 | 16. Cash Flow 💸 | 26. Fixed Assets 🏢 |

| 7. Balance Sheet 📋 | 17. Credit 💳 | 27. General Ledger 🧾 |

| 8. Capital 💼 | 18. Debit 💳 | 28. Gross Profit 💹 |

| 9. Cash Flow 💸 | 19. Equity 💼 | 29. Inventory 🏪 |

| 10. Depreciation 📉 | 20. Fiscal Year 📅 | 30. Journal Entry 📖 |

Conclusion

Mastering accounting terminology is a crucial step for anyone involved in the financial sector. These 50 terms provide a solid foundation for understanding the key concepts in accounting. Whether you’re analyzing a balance sheet, preparing financial reports, or simply managing your personal finances, knowing these terms will enhance your ability to communicate effectively and make informed decisions.

By familiarizing yourself with these terms, you are not only improving your vocabulary but also gaining the confidence to navigate the financial world with ease. Bookmark this guide and revisit it as needed to reinforce your knowledge and stay ahead in your accounting endeavors.

✨ Want to enhance your accounting vocabulary and boost your business English skills? Check out these 50 essential terms! Don’t miss out – follow and like @EnglEzz for more!

.

https://www.englezz.com/most-common-accounting-english-terms/

.

#EnglEzz, #vocabulary, #linguistics, #learnenglish, #accounting, #financialliteracy, #accountingterms, #businessenglish, #learnfinance